Why I Created Highlight Financials

Highlight Financials did not begin with a business plan or a clever brand name.

It started quietly, watching my husband build his business and realizing how much small business owners are expected to figure out on their own.

It became obvious very quickly: small business owners are expected to make big, strategic decisions without the financial support big companies take for granted.

In the corporate world, leaders don’t operate in the dark. They have finance teams, analysts, and accountants whose job is to translate numbers into insight and strategy. Someone is always there to explain what the data means, what it doesn’t, and how to use it.

Small business owners don’t get that. Many small business owners are a team of one, trying to do every role alone and learning it all as they go.

They are expected to somehow know what to look for, navigate reports, compliance deadlines, and manage tax obligations without even knowing where to start.

As his business grew, my husband started asking questions I had answered countless times in corporate roles:

“What does this actually tell me?”

“Is this a good decision, financially?”

“Can I afford this or should I wait?”

And the more small business owners we met, the more I realized this was not an isolated experience. It was a widespread gap in the market… and a deeply human one.

The Pattern I Couldn’t Ignore

I kept seeing the same cycle play out.

Financial reports didn’t make sense, so they were avoided. Avoidance turned into embarrassment, the quiet feeling that you should already know this. And too often, that led to tax filings that were overly conservative, incomplete, or simply incorrect.

That kind of avoidance doesn’t just create stress. It costs real money.

And what bothered me most was this: the people experiencing this weren’t careless or incapable. They were smart, invested, and working incredibly hard to build something meaningful.

They weren’t failing.

They were unsupported.

Why I See Numbers Differently

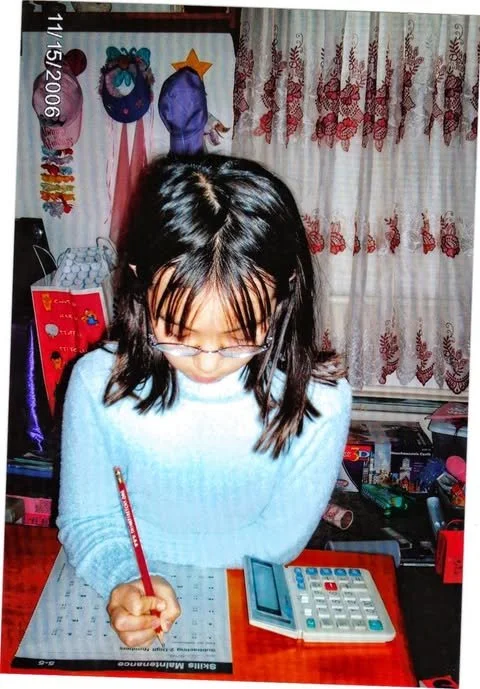

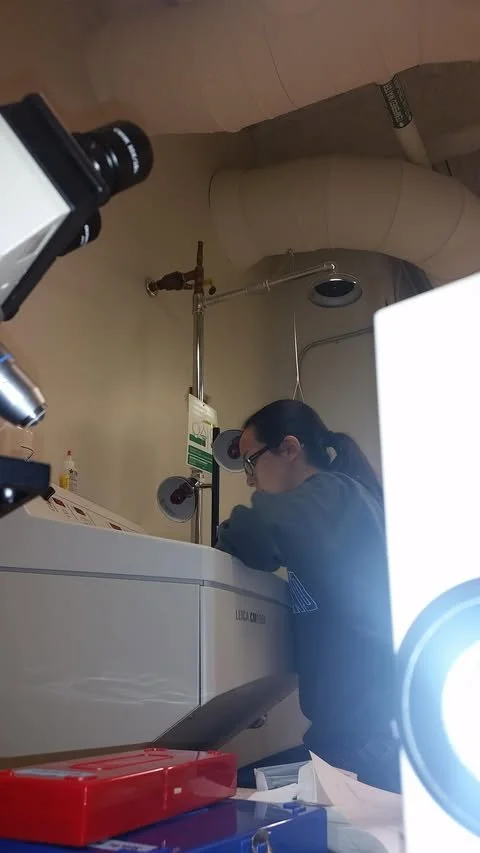

Before accounting, I was on a very different path: science.

I was trained to design experiments, analyze data, and follow information to its conclusion. I have always loved spreadsheets, clean systems, and a clicky 10-key. To me, accounting has never been about paperwork. It’s about the flow of information.

When you understand that flow, the story becomes clear. The numbers show what’s working, what’s risky, and what’s possible next.

But that’s only part of how I work.

I am also an empath to my core. I care deeply about the people behind the numbers—the pressure they carry, the fear of getting it wrong, the weight of being responsible for both a business and a family.

Highlight Financials exists at the intersection of those two things:

precision and empathy.

Why “Highlight” Financials?

A highlight does not rewrite the page. It does not judge what is there.

It simply draws your eye to what matters most.

That’s exactly how I approach finances.

At Highlight Financials, we don’t overwhelm clients with jargon or drop reports in an inbox and disappear. We slow things down. We explain what the numbers are actually saying, where risks may be hiding, where opportunities live, and what to do next—clearly, calmly, and without judgment.

We believe numbers are not just reports.

They are power tools, once someone shows you how to use them.

Challenging the Old Accounting Narrative

Many people come to me carrying assumptions about accountants: that we’re antiquated, buried in paperwork, condescending, or unwilling to explain things clearly.

Highlight Financials was built to challenge that narrative entirely.

We’re modern and collaborative. We use secure, efficient technology to make working together seamless, but we never forget that there is a person on the other side of the screen.

No judgment. Just strategy.

Who I’m Here to Serve

I’m especially drawn to women-led businesses, often run by parents, who are balancing ambition with partnership and family life. These are people walking a path I know well.

They’re curious. They want to understand what’s happening in their business. They don’t want to hand everything off blindly. They want to be involved, informed, and empowered.

Most of my clients are local to Scarborough, Maine and the Greater Portland, Maine area, and I serve businesses throughout the state. But what connects them isn’t geography.

It’s the desire for clarity.

What Clarity Makes Possible

When business owners truly understand their numbers, everything changes.

I’ve helped clients walk away from business acquisitions that looked exciting on paper but would have created long-term financial strain. I’ve helped others recognize the exact moment they were ready to hire their first employee, creating space for better balance and sustainability.

These aren’t abstract wins. They’re real-life decisions made with confidence instead of fear.

What You Can Stop Worrying About

As an Enrolled Agent admitted to practice before the IRS, with a strong technical accounting background, my role is to carry the complexity so you don’t have to.

Compliance. Tax strategy. Financial systems. Audit-ready records.

You don’t need to be nervous.

You don’t need to second-guess every decision.

You deserve support.

Redefining the Accountant–Client Relationship

Highlight Financials isn’t just about clean books or filed returns. It’s about redefining what it means to work with an accountant.

We build active, collaborative partnerships. We are proactive, not reactive. Strategic, not transactional.

Yes, we are accountants. But we are people first.

If you have ever felt overwhelmed by your finances, you’re in the right place. And if you’re ready to move forward with clarity, confidence, and informed decision-making, I would be honored to guide you.